revolving open end credit example

With open-end or revolving credit loans are made on a continuous basis as you purchase items and you are billed periodically to make at least partial payment. The first two months you dont use it and you pay nothing.

What Is Revolving Credit Examples Score Impact More

Revolving open-end credit typically does not specify a maximum amount that can be borrowed.

. When a loan is fully paid off at the end of the term it is called fully-amortizing. This credit limit is the maximum amount of money you have access to. The most common example of this is a credit card.

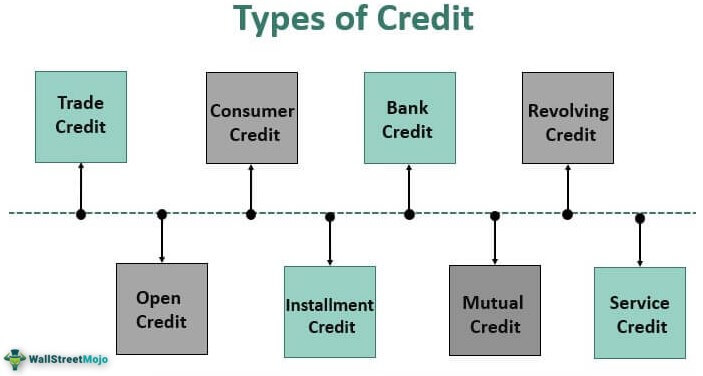

It is usually used for operating purposes and. The third month you draw out 10000. The 3 main types of credit are revolving credit installment and open credit.

If an open credit limit is not set the credit card is given and then one. Revolving credit is sometimes referred to as open-end credit or credit lines because you can literally access the available credit. Credit cards are an example of revolving open-end credit.

Revolving credit is a line of credit where the customer pays a commitment fee and is then allowed to use the funds when they are needed. A credit card is a common example of revolving credit. That means that you have.

Open-end credit on the other hand is revolving credit that allows you to continually access money as you make payments and only pay interest on what you use. In order to have. In order to have.

Open-end credit also called revolving credit can be defined as a line of credit that gives the borrower a certain limit of credit and the ability to frequently borrow as little or as much of that. A revolving line of credit is a preapproved loan or credit line that lets consumers and businesses borrow and repay money on a regular basis. Credit cards are an example of revolving open-end credit.

Revolving open-end credit typically does not specify a maximum amount that can be borrowed. With revolving credit you can make a minimum payment and carry or revolve the rest of your debt from one month or billing period to the next. When you carry a balance on a.

A loan can be of two types. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments. Auto loans and student loans are examples.

View Test Prep - Open End Credit examples from MATH 140 at Colorado Technical University. A line of credit is a type of open-end credit. It comes with an annual percentage rate APR.

The credit account can be used repeatedly provided your account stays open and all minimum payments are met. Open Credit has a feature of both installment credit and revolving credit. You can keep your revolving credit account open for months or years until you close the account.

Corporate Finance Institute. Open End Credit This is a type of credit loan paid on installments in which the total amount. A closed-end loan on the other hand is.

Credit enables people to purchase goods or services using borrowed money. The open-end loan is a revolving line of credit issued by a lender or financial institution. For example lets say you get a personal LOC for 25000.

If there is a lump sum due at the end of the term this is called a.

The Difference Between Revolving And Nonrevolving Credit Bankrate

Types Of Credit List Of Top 8 Types Of Credit With Explanation

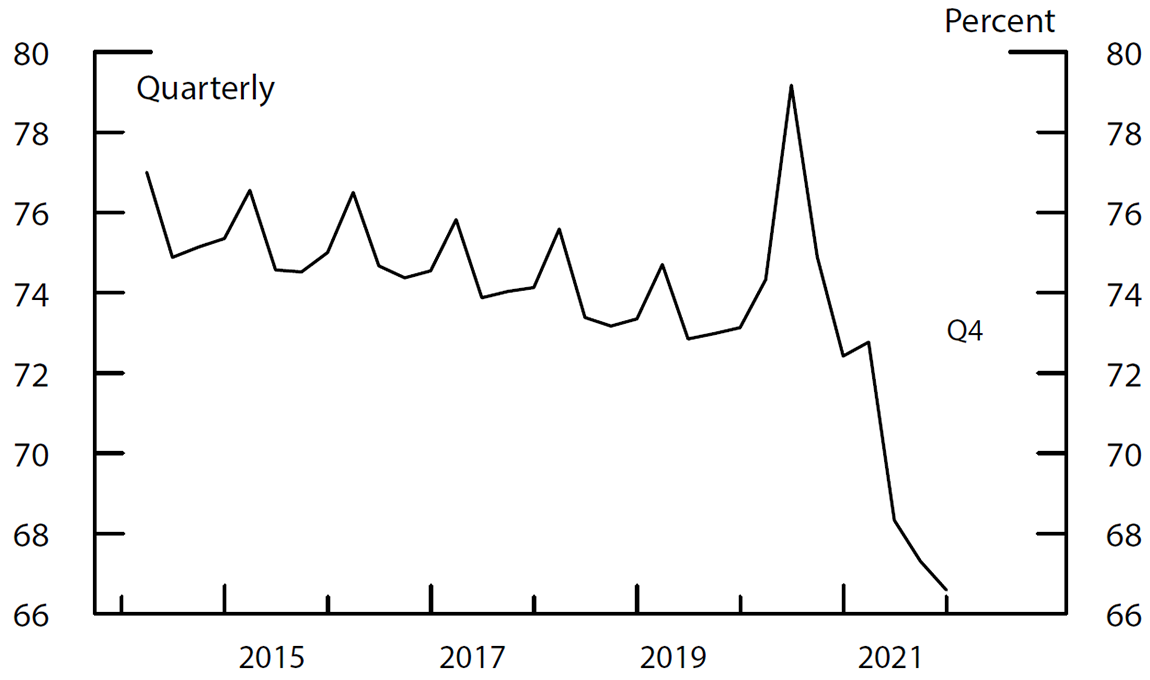

The Fed Credit Card Profitability

Expenditures Of Federal Awards Sefa Schedule 16 Office Of The Washington State Auditor

Open Credit Overview How It Works Advantages

How Revolving Credit Affects Your Score Ways To Avoid It Pointcard

Open End Credit Examples Open End Credit This Is A Type Of Credit Loan Paid On Installments In Which The Total Amount Borrowed May Change Over Time Course Hero

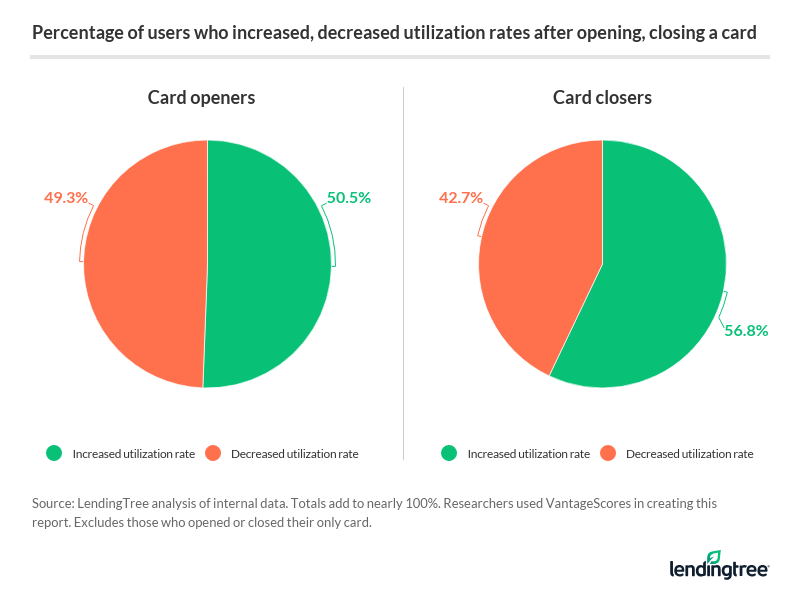

Credit Score Movements When Opening Closing A Card Lendingtree

Credit Card Terms 101 Glossary Of Common Credit Terms Moneygeek Com

Open End Credit Vs Closed End Credit Lantern By Sofi

Calculate Payments For A Revolving Line Of Credit Lendio

What Are Three Types Of Consumer Credit

Revolving And Non Revolving Credit What S The Difference Gocardless

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

What Is Open End Credit Experian

The Benefits Of A Revolving Line Of Credit For Your Business The Callaway Bank

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-loan-and-line-credit-v2-c8a910fad66a476db1a4c013517eefbb.jpg)